Taxation or Borrowing: Which is Better?

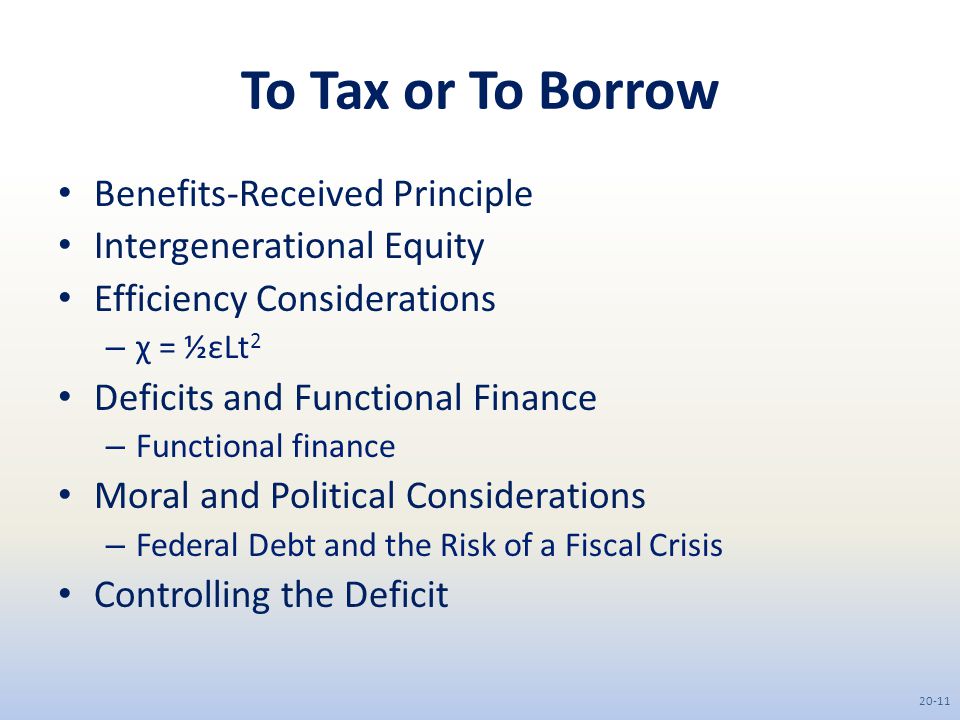

Is it better that a community have its government tax or borrow to fund public expenditures? The answer to this question would seem with cursory thought obvious to any person. For those confident that Taxation is the correct answer there is a great surprise to be unveiled. The following proof confirms the opposite: That Borrowing is invariably the better choice.

Let us say that government shall fund public expenditures in 2 scenarios: Taxation and Borrowing with effects wrought upon the aggregate Disposable Income (Y) of a community. Two time periods, T1 and T2, are required to illustrate, firstly, initial taxing and borrowing and, secondly, subsequent repayment of borrowed funds. Govt. expenditure has a value of G in T1 and nil in T2. Only resident citizens may lend to the government.

Scenario 1 – Taxation

T1: Disposable income is Y1 – G.

T2: Disposable income = Y2.

Scenario 2 – Borrowing

T1: Disposable income is Y1 – G = Y1 – loaned Savings (S) = Y1 – S

T2: Disposable income is Y2 – public debt + loaned savings, both with interest (R) added = Y2 – S(1 + R) + S(1 + R) = Y2 – 0 = Y2

An amount of money, S which equals the cost of the public good G, has left the accounts of community residents in the scenarios of Taxation and Borrowing. In Borrowing, community residents, specifically, its lenders are enriched with an asset or IOU of S after ceding funds for G, and community residents are burdened with an equivalent liability of S or the claim against the aggregate Disposable Income or Y of the community.

After a time, the public debt claimed against Y and the equivalent IOU added to Y have grown to S(1 + R), R being the rate of interest. The accrued public debt: S(1 + R) annihilates the IOU held: S(1 + R), leaving the remainder of Y2 under both scenarios of Taxation and Borrowing.

The startling conclusion is that it makes no difference whether a community has its government tax or borrow to fund public expenditures. By levying taxes to erase the incurred debt and IOU of S (1 +R), the community is no better off in the transaction.

Thus, Pure or True Ricardian Equivalence as advocated by David Ricardo in the early 19th century, not Barro’s recent and contrary Ricardian Equivalence Theorem, does exist theoretically and appears irrefutable. David Ricardo was right though he may have lacked the tools to explain why. I offer $10,000 to any person able to find the flaw that defeats this proof.

It is well known that there are huge costs in Taxation in squander and deterrence. Bereft of Taxation or the right to take the money of its citizens, financial slaves become public bankers and government may no longer do as it please. The novel circumstances, with roles of tyrant and slave reversed, shall compel Government to justify every public expenditure and action. Not only the costs of public investments, but more importantly the benefits shall be rigidly and truthfully assessed and accounted.

Disposable Income in T1 under Taxation would be as before at Y1 – T. Under Borrowing it would rise to Y1 – (x)G, where ‘x’ is the percentage of worthy public expenditures found within total public expenditures. Milton Friedman remarked that public expenditures in Britain in the 19th century, with navy, empire and growth rates at their highest, never rose above 10% of GDP. The astounding implication is that with Government expenditures in Britain at near 50% of GDP the value of x would be 0.2, which would see the aggregate disposable income of British citizens rise by 80%: Y1 – .2(.5GDP) = Y1 – .1GDP = .9GDP instead of .5GDP . Even with a fall to 40% of present public expenditures, disposable income still would rise by 60% to Y1 – .4(.5GDP) = .8GDP from .5GDP

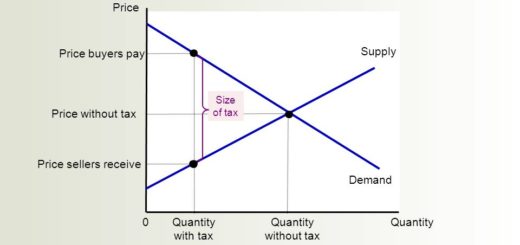

Secondly, the Deadweight Costs of Taxation, a penalty upon the productive, are immense and greatly curtail worthy economic activity. With crushing penalties lifted, those formerly reluctant to labour as much as they might with Taxation shall do so knowing they retain all wages. Companies forced elsewhere, or forced to limit or cease operations shall recommence worthy domestic production knowing that its owners shall retain all profits.

Let us say that Deadweight Costs of Taxation are approximately 30% of GDP, more if taxes are punitive and less if moderate.

If G = .1GDP,

Y = 1.3Y – (x)G = 1.3Y – .1GDP = 1.2GDP.

If G = .2GDP,

Y = 1.3Y – .2GDP = 1.1GDP.

This is quite a departure from Disposable Income of Y = .5GDP and constitutes an explosion in wealth by substituting Borrowing for Taxation. So I must ask why a community has its government tax instead of borrow to fund public expenditures?

Some have argued that none would never lend to a government bereaved of the means of Taxation.

Let us imagine Taxation remains a tool of government in acquiring funds for expenditure. Should a government wait until the country’s life expires, until that distant date to perform a general confiscation to settle all public debts? Or is it better that government tax throughout the life of a nation with the community incurring continuously Taxation’s heavy costs and greatly impeding a prodigious accumulation of wealth?

I think all would agree to wait until the appointed settlement day to perform the confiscation and annihilate all public debts. Government shall tax, but only when that distant point arrives. Until then, all Taxation is dormant.