Real Growth Through Tax Cuts

The Path to Prosperity

For decades this province has let large numbers of people and precious money and investment flee this  province for far better opportunities elsewhere. For those that remain life has only become much worse. None of Manitoba’s political leaders of the past possessed the will or wisdom to halt or slow this tragic loss of so many educated, gifted and ambitious people. And the present political leaders in another election season sound the same tired and bankrupt notes.For the many people struggling there are no tax cuts, no improvements in the substandard education given our children, little improvement in the sorry state of our roads, no help for the idle, no answer to the shortage of rental apartments, no reduction in health care lineups, no easement of endless regulation or rising costs. We just get the same old, tired platform of ever expanding government, meaning so little in return for so much taken.

province for far better opportunities elsewhere. For those that remain life has only become much worse. None of Manitoba’s political leaders of the past possessed the will or wisdom to halt or slow this tragic loss of so many educated, gifted and ambitious people. And the present political leaders in another election season sound the same tired and bankrupt notes.For the many people struggling there are no tax cuts, no improvements in the substandard education given our children, little improvement in the sorry state of our roads, no help for the idle, no answer to the shortage of rental apartments, no reduction in health care lineups, no easement of endless regulation or rising costs. We just get the same old, tired platform of ever expanding government, meaning so little in return for so much taken.

It is the people and firms of Manitoba that engineer and produce the goods we all seek. Government at any level does not put food on tables, gasoline in tanks, roofs over heads, or computers on desks. Or they do at the highest possible price only because they possess monopoly protection or regulatory exemptions. But government is well able to make huge sums of money, earned by productive hands, disappear in an instant. And these incontinent magicians never find a limit. Government is already far too large for the economy that supports it. The burden is crushing every worker, every family, every pensioner. We must make do with far less so that our insipid leaders can take far more – and waste so much.

There are many people like yourselves: frustrated and angry at the contempt the ruling class shows for the people they supposedly serve, frustrated and angry at the unending parade of asinine policies and deeds that hit us hard and daily.

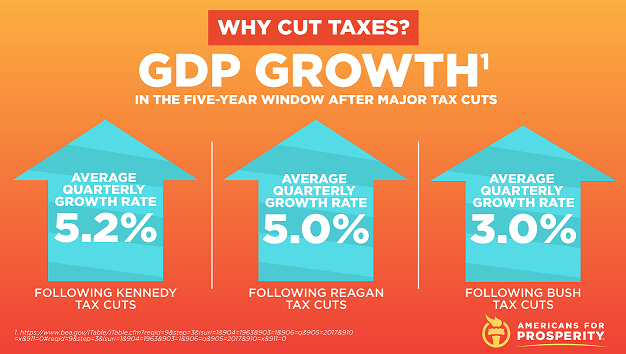

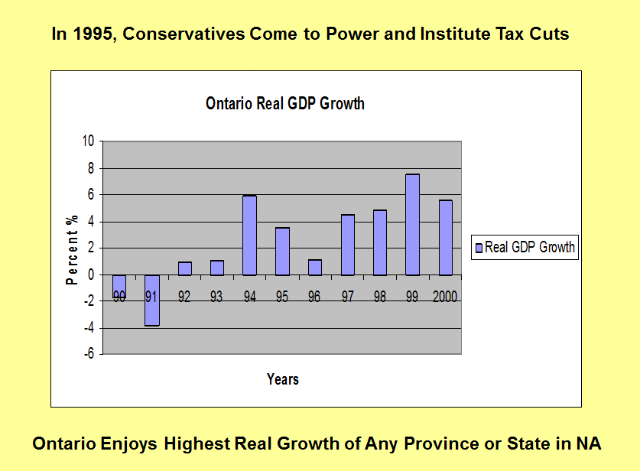

We have an answer that will rid us of many of our troubles. This province needs real growth, like that found in Saskatchewan these last 10 years, like that found in Ontario in the mid to late 90’s. And the simple means to this desperately needed growth is TAX CUTS.

Should the Manitoba Party, this unusual group of average janes and joes, form the next government we guarantee that Manitobans, most just struggling to get to the next day, will enjoy the lowest tax rates in this country and all the blessings of wealth and security that arise.

Taxation

Many will claim that Manitoba is in no position to reduce present levels of Taxation. They claim that reductions will invite deficits and deficits will invite ruin.

When one argues against tax cuts, what he really argues is that one should not reduce tax revenues. Those that clamor for tax relief only seek tax rate reductions. Both camps often seem unaware that adjustments in the rates of Taxation generally have the opposite effect upon the revenues of Taxation.

A tax is a deterrent, penalty, or fine . It deters one from doing what he normally would were there no tax. Remove or lessen that deterrence and people and firms, ceding far less to government, will have more money with which to invest, consume, retire debt, and save. Worthy economic activities squelched, halted, curbed, delayed or concealed will of a sudden re-emerge and resume. Firms and people having sought tax refuge elsewhere will have every reason to return home.

If an economy with a GDP amounting to $1 billion devoid of taxes is subjected to a 50% income tax, will the size of the economy grow, remain the same or shrink? it will shrink. perhaps to $700 million, limiting the tax yield to $350 million instead of the expected $500 million. And if an economy with a GNP of $700 million and a 50% income tax rate saw that rate abolished, would it grow, shrink, or remain the same? It would grow perhaps to $1 billion.

It is easily reckoned in public finance that a doubling of the tax rate upon some specific good shall yield a doubling of the revenues gained from that good; That a halving of the tax rate upon a specific good shall result in a halving of the revenues gained from that good. Most through long experience with taxation and tax rates know better. In public finance, 2 + 2 in tax rates applied never equals 4 in revenues gained.

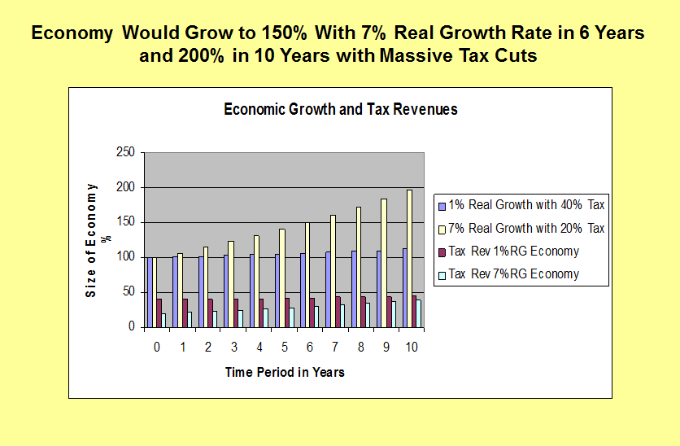

By diminishing excessive tax rates, instead of sluggish growth of 1 or 2% per year the economy will thrive at rates of 5, 6, or 7%.

Compounding over a 6 year period, a 1 per cent real growth rate would spur the economy to 107% of its initial size. An elevated real growth rate of 7% per year would spur the economy to 150% of its original size.

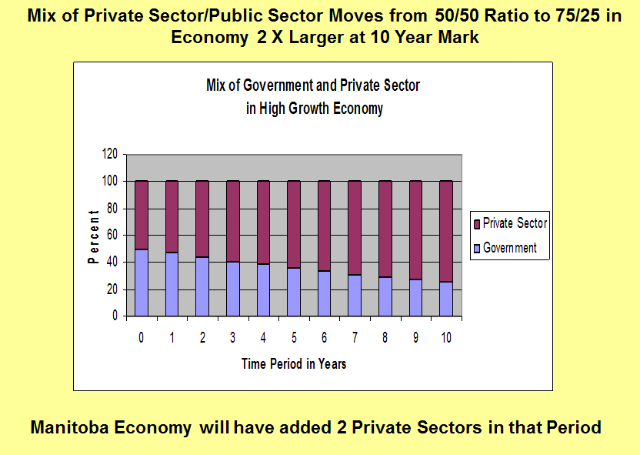

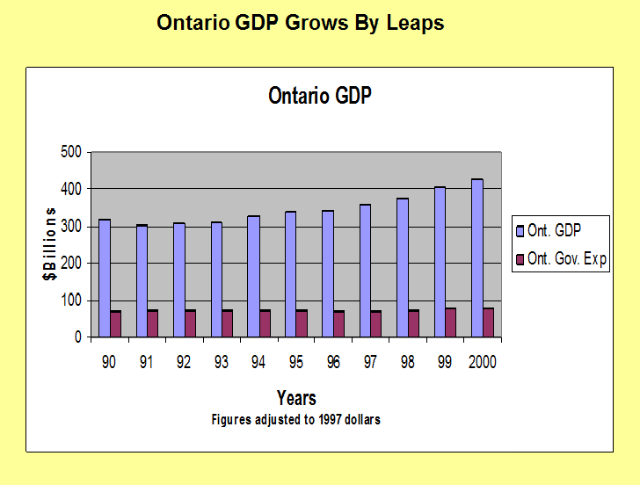

If the private sector initially comprised 50% of the economy, at the end of the 10 year period with government growth restrained, the private sector would comprise 75% of an economy twice the original size. Manitoba will have added the equivalent of two private economies in 10 years. Therefore, one would expect far greater tax revenues were income taxes halved.

These are just projected values. There are too many variables that come into play greatly complicating results. But it makes clear that the answer to all our major problems is real economic growth and the means to that end is tax cuts.

In conclusion, increase tax rates and, all things being equal, the revenues from those elevated rates will in time stagnate or decline relative to an economy free of such an imposition. Decrease tax rates and, all things being equal, tax revenues will in time surge.

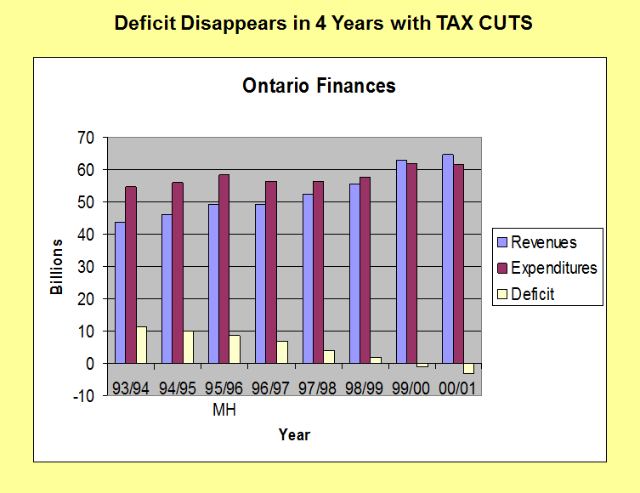

Ontario was suffering under a $10 billion dollar deficit during the Bob Rae regime. Mike Harris and the Conservatives won the provincial election in 1995 and instituted tax cuts among other beneficial measures. Ontario enjoyed the greatest growth of any province or state in North America. Within four years, those tax cuts erased the $10 billion dollar deficit — ERASED WITH TAX CUTS.

| Year | Revenues | Expenditures | Deficit |

| 1993-4 | $43.6B | $54.8B | $11.2 |

| 1994-5 | $46.0B | $56.1B | $10.1B |

| 1995-6 | $49.4B | $58.2B | $8.8B |

| 1996-7 | $49.4B | $56.3B | $6.9B |

| 1997-8 | $52.5B | $56.5B | $4.0B |

| 1998-9 | $55.8B | $57.8B | $2.0B |

| 1999-0 | $62.9B | $61.9B | Surplus$1.0B |

| 2000-1 | $64.6B | $61.6B | Surplus$3.0B |

Mike Harris was astonished the deficit vanished in just 4 years. He said he wished he had cut faster and deeper.

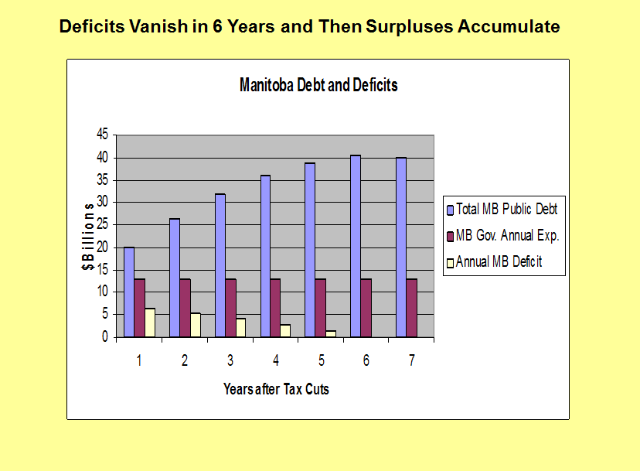

And the same explosion in growth will occur here. Manitoba government expenditures are now about $13 billion and the total provincial debt is about $20 billion. If large tax cuts are implemented and government spending kept in check, suppose tax revenues halve say to $6.5 billion, with the deficit then of $6.5 billion borrowed from resident Manitobans. But now real growth in private and productive economy starts to accelerate, and tax revenues will rise start to rise from their lowly state. The deficit should decline say to $5.5 billion the next year, then $4.2 billion, then $3.0 billion, until at the end of 6 years it vanishes. Then the surpluses commence and accumulate.

At the 10 year mark, if the economy has doubled in size with most or all of the growth coming from the private economy and the debt has doubled, then the ratio of provincial debt relative to GDP remains unchanged. However the economy has grown by leaps. We are all far wealthier.