Who or What Funds Government?

It is commonly thought that Government funds government; That Government furnishes the funds with which it pays its bills or settles it debts. This errant reasoning has marred the theories and practices of public finance for centuries, causing great harm and destruction to peoples throughout the world and throughout history.

I had thought the first premise in my proof , that the taxpayer funds government, a truism. I did not believe it required explanation. I thought one would assent to it with ease, pleasantly acknowledging the irrefutable fact. I did not foresee the questioning, evasions, obstinacy, and combativeness that this simple premise would rouse. So, I will dwell on the matter a time.

As I have said on this website repeatedly – All my work forms its foundation in one self-evident truth, that government does not fund government. It does not fund public expenditures. It does not settle its debts. It never has and it never will.

Government has not contributed one dime to its expenditures since its inception. It possesses no hoard of money, no assets, no financial instruments with which to meet its daily needs. I shall concede that government certainly pays its bills, however, it never furnishes the funds with which to pay those bills.

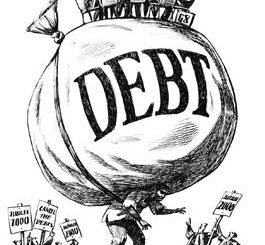

Nor does government possess the means to settle its debts. In truth, history repeatedly assures us that public debts once incurred endure forever. Government rarely reduces the accumulating amounts. If it does, the rare effort demonstrably yields negligible results. Soon the desire for greater government extinguishes the flaccid impulse, and debt creation resumes vigorously. Even if the government earnestly sought to reduce the public debts, its contribution to the effort would amount to nil for the same reason that it can never fund its expenditures. It does not, never has, and never will possess the means.

Many naturally assume the government is in deficit to amount of money expended in excess of tax revenues. Not so. The deficit comprises the whole of government expenditures, those outlays funded by both Taxation and Borrowing. To construe the delinquency as the slight gap between the revenues of Taxation and total expenditures challenges both sense and reason. Whether borrowed or taxed, the source of funds is undeniably without government.

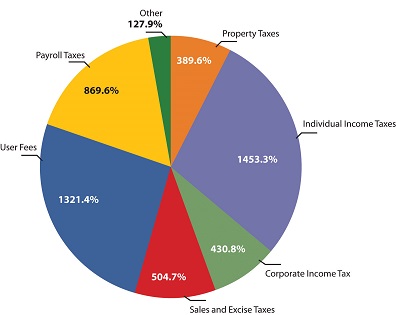

If one should wish to know whether a certain government can raise 1 dollar, 10 , or 20 billion dollars, a cursory examination of its finances will never decide the matter. One must look elsewhere for answers. The financial records of government reveal unceasing expenditures and inflows of money, which issue not from sales receipts, returns on investments, interest on savings, wages received for work performed, but rather from the confiscation of monies derived from the property, and the transactions and exchanges occasioned by the trade of others. Thus, government is wholly reliant upon the charges levied against such property and trades. Examining the finances of government will leave the inquirer incapable of rendering a clear answer on the question of public credit. Only by examining the wealth of those engaged in trade, those residing within its sovereign domain, will the enquiry bear fruit.

Imagine a man without occupation, assets, or source of income walking into a bank seeking a loan of $100,000 for a sports car? What banker would lend the seemingly improvident fellow 1 dime? Suppose that the fellow refers to a wealthy patron as the source of his funds. I would think that the banker would immediately request an interview with the patron to ascertain security and fix terms of the loan. And that is exactly how a judicious banker would determine the rate of interest and terms to be affixed to a public loan: by assessing the wealth, income, assets, liabilities, of those accountable for the obligation — the inhabitants comprising the affected jurisdiction.

Some have asserted that Government does garner revenues from certain profit seeking businesses such as utilities, from mineral rights to properties in production, liquor marts and beer stores, postage, toll roads, rents from public lands, casino operations, etc.

This is somewhat true, but such ventures rarely operate freely in competitive markets among keen rivals. Public businesses, often granted a monopoly or armed with especial regulations, are well protected from challenging firms offering similar or superior products. In my home province of Manitoba, the Government has arrogated the supply of a number of goods to functionaries little concerned with quality of goods or expected courtesies inherent in their sale and use. Liquor, frequently a sparse offering, must be distributed and sold by designated outlets, often owned and operated by the always highly compensated government employees. Only Manitoba Hydro may generate and sell electricity within the province, permitting the authority to charge whatever rate it desires. Only MPIC may sell automotive insurance. Only the province may operate or license casinos or the varied forms of gambling, once primarily an outlawed vice until the avaricious minds of government discerned its potential in fuelling ever greater government.

Government has annexed title to mineral rights on lands they do not own. The Alberta Government owns about 4/5 ths of the mineral rights of properties within its domain. It would have seized all had there not been identified mineral rights in place before the establishment of the province. The royalties which the exploitation of minerals generate should be remitted to those who own the property, those who truly own the rights. Otherwise they should count as the income of the firm engaged in extracting those minerals, performing the deft work to bring those desired minerals to the market place. Sadly, such enterprising companies or plundered property owners do not count a legislature among their persuasive instruments.

Toll roads, with lands commandeered by legislative enactment, are publicly funded arteries of which the public face additional financial imposition should they use them.

Whatever government enterprise one may evince as exemplar of profitable and fruitful undertakings, the circumstances of its operation are unlike those of any other firm freely competing in the market place. Government is not a Sears store inviting in and persuading customers of the values inherent in stocked goods. The public has no freedom to depart the government store with money and property intact. They must pay whether the goods are plentiful or scarce, exceptional or inferior, cheap or dear, vital or worthless.

How I am so frequently reminded of the Communist Meat Shop. A grocery operation in a country in which every industry was directly controlled by the government. In the meat shop, one would find a mob of government workers wandering about. Outside, one would find extensive lines of people clutching their vouchers or money, of which there was great abundance. In economics, this is known as demand. But what was the problem with the Communist Meat Shop? What element was missing? As mentioned, managers, clerks and labourers were plentiful. So were those seeking goods. Money or vouchers were held by all. The government was everywhere. But what was missing from the Communist Meat Shop?

There was little or no meat to be had. And if this noxious drift to ever greater government continue, we shall soon have our very own Communist Meat Shop, and every other Communist shop imaginable.

The foundation of the Ptolemaic system, or geo-centric universe, rested upon good evidence, observations of the stars. However, among those observations, one may have noticed certain disparities in the movements of the planetary bodies more proximate. Heedless of the small but significant observations, the Ptolemaic theorists suffered perpetual fallibility.

Many have fallen into a grave error regarding the nature of the aptly designated public finance: the nature of the nation’s financial obligations and the source of their settlement. Yet, the cause of this mal-conception cannot be fixed upon disconcerting or baffling observations. All evidence clearly marks the source of funds for public undertakings. And it is not the government.

The Taxpayer is the source of the outlays for public expenditures. The assorted and bewildering impositions on his wages, profits, consumption, savings, investments, property, financial holdings, inheritance, commerce, and trade supply the Government with the means to disburse, borrow and settle. He is the one who meets the full obligations of Government.

The inability to recognize and account this palpable fact has fostered and reinforced the worst of conclusions, the worst of practices in economics, and the worst of consequences In our day, the most productive people in the nation are persecuted by the ruthless and broad apparatus of the tax collector. They are compelled to surrender great fractions of their meritorious efforts in order that those incapable or marginally capable of like performance, those dependent upon or employed by the governing body, the friends and allies of those in power, may greedily and belligerently divide the spoils.

Hold this one thought in high regard, “ The Taxpayer, Not the Government, funds government.” Acknowledge this simple truth and one may immediately reason and know that Taxation, as intrusive as it is destructive of wealth and well-being, is in its twilight. Accept this clear and irrefutable fact, and the rest of what I argue follows logically and soundly.

Given that a community of Taxpayers funds government, it is their finances: their assets, incomes, property, and money, one must look at and examine in order to answer basic questions about funding public expenditures. In doing so, one may easily discover that it makes no difference whether a community taxes its citizens or borrows from its citizens to fund public expenditures. If one should add to the assets of community residents whilst simultaneously creating an equivalent liability or claim against said assets, then one has not altered the aggregate finances of the community’s residents. Nor are they altered if one should simultaneously extinguish an asset and equivalent liability.

If a community through its agent, the government, issues a bond, that bond will add an equivalent amount to the community residents’ assets, specifically the assets of those who lend, and to the claims upon or liabilities against those assets. If a community has its government extinguish that bond through repayment, the action will erase not only the asset held by community residents, but also the liability claimed against the assets of community residents.

If this is agreed, then it is easily conceded that Taxation, a penalty, and Borrowing, an inducement, though yielding the same result, possess little equivalence between them, Ricardian or otherwise, as a means of raising funds. Taxation bears immense costs in Government squander and in deterrence that disappear under full Borrowing. So why does a community tax with all its inherent and punishing costs to fund public expenditures when it can borrow, escaping these financial ills, and unleash great wealth for its citizens?

I hope this helps with the reading of the proof. Accept the first premise, that the Taxpayer funds government, and all follows logically and soundly. Reject it, and one must perform a feat of magic to convince myself and every other taxpayer of the truth of it.