The Ricardian Equivalence Dodge

200 plus years ago a fellow by the name of David Ricardo posed a very unusual idea: that government should borrow to fund public expenditures rather than tax. He was right, though such an idea may seemingly confound reason.

The idea was ignored until the 1960’s and 70’s, when several researchers resurrected and investigated the idea. Those efforts resulted in what is known as the Ricardian Equivalence Theorem, advanced by several persons, most notably Robert Barro. The researchers essentially concluded that it would be reckless to suspend Taxation, let public debts rise to outrageous limits, then re-institute Taxation, perhaps generations later, to reduce or erase accrued debts.

Many persons have advanced the Ricardian Equivalence Theorem as a refutation of my idea. I have never understood why this Theorem, laden as it is with blunder after blunder, serves to overturn the argument for the abolition of all Taxation. Barro’s version takes a rather strange path to an even stranger conclusion. I could see how one might use it to reject my argument impulsively. However, an examination of the Theorem, its poor assumptions and reckonings, or rather the variant below provided by an able researcher, should squelch this unreasoned impulse for good. In fact, the Ricardian Equivalence argument does not defeat the proof, and strangely confirms it – to a point.

This is not a difficult theorem to follow, so all should be able to get through it.

In the challenger’s own words:

Variation of the Ricardian Equivalence Theorem

There are two flaws in the argument (that is my argument that a community is better of borrowing):

- The type of lending proposed will not occur in the absence of a commitment of the government to tax.

- The assumption that the asset=liability is only true under very specific conditions.

Let me begin by formalizing the setup and the argument. I will keep it as simple as possible. But before I do this, let me highlight what, in this context, is the distinction between taxes and borrowing/lending (it’s obvious in “real life” but we need an actual formal distinction): taxes are coerced while lending is a choice made by citizens/individuals.

Setup 1

There is a government that needs to fund a public good. The cost of this good is ‘T’ and it will generate, let’s say, a flow of services ‘g’ to every member of the community in every period. Note that I am assuming that the government is providing a public good and, therefore, there is a need for a government to begin with (the whole argument is about how the funds from the community should fund the government). Because we are talking about Lending and Borrowing, we need more than one period. Let’s assume, without loss of generality, that there are 2 periods. There is a community that generates/receives income Yct in periods t = { 1,2 }. The argument proposed is the following:

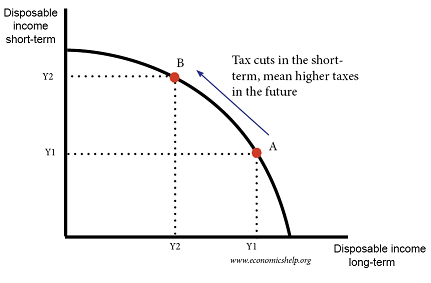

Scenario 1: Taxes

The government taxes the community by amount, T, in the first period and produces the public good, g. Thus, the community receives Yc1 – T disposable income and g services in the first period, while it receives Yc2 disposable income and g services in the second period.

Scenario 2: Borrowing

The government borrows T from the community in the first period and produces the public good, g. Thus, the community receives Yc1 – SC or rather Yc1 – T disposable income (where SC are the communities savings which turn out to be lent to the government) and g services in the first period. The interest rate r is such that the community wants to lend an amount T to the government. The community would receive Yc2 + T (1 + r) disposable income and g services in the second period if the government actually had resources of its own. It doesn’t. So, to pay back the T (1 + r) to the community, the government needs to levy a tax of the same amount on the community itself. Therefore, disposable income in the second period is Yc2 + T (1 + r) – T (1 + r). Thus, the claim in the challenge that assets are equal to liabilities. This is all mediated by the proposed “key insight” that the community is the one that funds the government so it would need to pay itself the amount that it owes to itself.

In summary, there are two scenarios covering two time periods. In the first scenario, in the first period the community warrants its government to tax in order to fund a public good, and in the second period the author examines the results as indicated by Disposable Income. In the second scenario, in the first period the community has its government borrow from its citizens to fund the same public good, and in the second period the author describes consequences and required actions.

In Scenario 1: collective income for a community in period 1 is Y1 and T is the cost of public goods, g. The equation for collective Disposable Income in period 1 becomes Y1 – T.

With the public investment made and flow of services, g, obtained, the equation for collective Disposable Income in the second time period consists solely of Y2.

In Scenario 2, the government borrows rather than taxes. In the first period, the equation for collective Disposable Income then becomes Y1 – S where S is savings used to fund the government expenditure of T. So Y1 – S becomes Y1 – T. In the second period, collective Disposable Income becomes Y2 + S ( 1 + R ) where R is the interest rate and S ( 1 + R ) is the public IOU acquired by lenders in funding the government good, g. But, as the author notes, a community debt has also been created in the amount of S ( 1 + R ). So the equation becomes Y2 + S ( 1 + R ) – S ( 1 + R ).

The equation, Y2 + S ( 1 + R ) – S ( 1 + R ), before taxing and termination of public debt, exactly coincides with the equation found in my proof and verifies the conclusion that it makes no difference whether a community taxes or borrows from its residents to fund public expenditures. An amount of money S or T, the cost of the public good, has left the accounts of community residents in the scenario of Taxation and in the scenario of Borrowing, never to return. In the Borrowing scenario, the community residents, specifically, its lenders, are enriched with an asset, S ( 1 + R ), and the community residents are burdened with an equivalent liability, S ( 1 + R ). The aggregate financial position of the community residents is unchanged before and after the transaction. Add interest to both the debt and asset and the aggregate financial position of the community residents is unchanged. Erase the debt and asset of community residents through Taxation and again the aggregate financial position of residents is unchanged.

Thus, Pure or True Ricardian Equivalence as advocated by David Ricardo in the early 19th century, not Barro’s recent and contrary Ricardian Equivalence Theorem, does exist theoretically and appears irrefutable. David Ricardo was right though he may have lacked the tools to explain why.

Two Issues

Firstly, the author of the variant does concede in the conclusion of the first setup that financial assets do equal financial liabilities at aggregate levels. Then he comments that ‘Regrettably such is not the case at the individual level.’

Why this is a problem I cannot explain. When lenders offer funds, they do so because the sums held are superior to their needs. They wisely seek returns for idle money. If the interest rate obtained is satisfactory based upon considerations of risk and reward, then one is happy to lend. For those unwilling or unable to lend because of better returns elsewhere, of commitments to family or business, or because he subsists on limited wages and possesses no savings, then all the better that they are not forced to yield funds as they would under Taxation. There are options in Public Borrowing that are not available under Taxation. This alleviates or expels a vexatious harm, it does not create or encourage one. All residents shall lend according to their means. Some will lend greatly, others only marginally and a few not at all. The government is only interested in garnering the total funds needed for public expenditures. From whom and the means by which they arrive matter not at all.

Secondly, the author claims that Government in absence of Taxation cannot borrow: “The type of lending proposed will not occur in the absence of a commitment of the government to tax.”

I have never claimed that government is forbidden from employing the instrument of Taxation. I have only confirmed in the scenario above, that repayment of public debt, distinct from repayment of public lender, leaves the aggregate financial position of a community’s residents unchanged. The community through its government incurs a debt, and it also acquires an equivalent asset, leaving the community in no better or worse a position. The financial position of the community is unaltered with the transaction. One nullifies the other. When the community retires a debt, it also retires an asset, leaving the community no better or worse financially. Therefore, if the community demands its government retire a debt by employing Taxation, the transaction achieves nothing, whereas the costs to the community in the deadweight losses of Taxation and in government squander are great. A rational being would never perform an action that has great costs and no benefit. As demonstrated it is never in the interest of a community to have its government repay or reduce public debts by Taxation.

The author claims that none would lend were they never to see those funds again. This is correct. But to claim that a borrower must reduce debts in order to repay his creditors is a different proposition and clearly erroneous. Governments, firms, banks, individuals for most of their lives, all carry debt. The debts or liabilities of almost every nation, firm, individual, bank, are invariably greater in the present than they were in the past, and shall be greater tomorrow than they are today. The public debts of Canada, the US, Britain, France have grown with time; the debts of the Royal Bank of Canada, Bank of America, JP Morgan have grown; the debts of IBM, Amazon, CN have grown; my personal debts and those of most other people have grown.

How do so many needy entities satisfy the wishes of their creditors without reductions in aggregate debts? Simply, they exchange one lender for another. Banks, corporations, individuals, governments all act accordingly. If the cost of retiring a debt is immense and the benefit less or nil, why retire a debt? One would continue to service the debt, or if the lender requires return of funds, find another lender. This is standard bank practice. This is a practice that every corporation and nation employs and every individual for most of his life.

And why do most creditors gladly retain the paper of enterprises whose liabilities grow daily? Because most, not all, manage to forge assets superior in value to their accruing liabilities. As long as the borrower adheres to this term, the creditors are happy. Violate that term, and creditors murmur. Violate it repeatedly, and creditors depart or remain only when returns reckon with new risks. It never matters what one’s debts are. It matters what one’s assets are. As long as the latter exceeds the former by some margin, lenders shall always be plentiful.

Correcting the Mistakes

The authors of the Ricardian Equivalence Theorem and those of its variants, have blundered badly, failing to see the poor and errant reasoning contained within the Theorem’s premises.

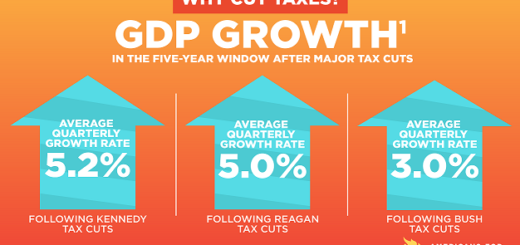

Firstly, all have failed to note that a large disparity in Disposable Income would arise in the scenarios presented. Taxation is a penalty, a fine. Borrowing is an inducement. To imagine that conditions and factors in the provision of public goods and in the desire of the populace to work and profit would remain equal given these vastly different methods of raising funds is a gross miscalculation.

Bereft of Taxation or the right to take the money of its citizens, financial slaves become public bankers and government may no longer do as it please. The novel circumstances will thrust Government into justifying every expenditure and action. Not only the costs of public investments, but more importantly the benefits shall be rigidly and truthfully assessed and accounted. If a public project fails to meet the standard of superior benefits, then it is discarded until more conducive circumstances arise. Ignore such analysis and a hostile public banker shall refuse to lend until reckless fiduciaries are discovered and punished. In the example above, the public good funded may not be worthy, or it may be so only at a much reduced cost.

With the government facing its bankers daily, corruption and squander within the halls of administration and legislature shall decline to a shade of present size, and public expenditures shall decline precipitously. The large fraction of a community’s financial resources, labour, materials diverted by its governing body to the most worthless of ends shall be released to find employment in fruitful and profitable enterprise. By this measure, the community’s wealth shall grow to unprecedented heights.

Disposable Income in the first period under Taxation would be as before at Y1 – T. Under Borrowing it would rise to Y1 – (x)T, where ‘x’ is the percentage of worthy public expenditures found within total public expenditures. Milton Friedman remarked that public expenditures in Britain at the height of its empire in the late 19th century were no more than 10% of GDP. The astounding implication is that with Government expenditures in Britain at near 50% of GDP, the value of x would be 10/50 = 1/5 or 0.2, which would see the aggregate disposable income of British citizens rise by 80%: Y1 – .2(.5GDP) = Y1 – .1GDP = .9GDP instead of .5GDP . Even with a fall to 40% of present public expenditures, disposable incomes still would rise by 60%.

Secondly, the Deadweight costs of Taxation, a penalty upon the productive, are immense and greatly curtail worthy economic activity. With crushing penalties lifted, those formerly reluctant to labour as much as they might with Taxation shall do so knowing they retain all wages. Companies forced elsewhere, or forced to limit or cease operations shall recommence domestic production knowing that its owners shall retain all profits.

Therefore, under Borrowing, Disposable Income and the amounts saved by prospering residents should swell and broadly surpass the income and savings obtained under grievous penalties of Taxation. Suppose Deadweight Costs of Taxation are approximately 30% of GDP, more if taxes are punitive and less if moderate. Disposable Income in period 1 would rise to 1.3Y1 – (x)T or 1.3Y1 – .1GDP if public expenditures fall to 10% of GDP. If to 20%, then Disposable Income would become 1.3Y1 – .2 GDP. This represents an explosion in wealth over the previous Disposable Income in period 1 of Y1 – T or Y1 – .5GDP. I must reject the contention that disposable income shall remain equal or similar under both scenarios as detailed in Barro’s Ricardian Equivalence Theorem.

The authors and advocates of the Ricardian Equivalence Theorem incur fundamental errors in their assessment of and conclusions about public borrowing. Government use of a nation’s productive resources shall decline sharply and the deadweight costs of Taxation disappear with full Borrowing for public expenditures. The wealth of a nation’s citizens shall rise without precedent.

It has been said that the authors of the Ricardian Equivalence Theorem received Nobel Prizes for their efforts. I would suggest that those learned persons, lest the committee discover these errors, hide them.

You should pay your challenger the money. He’s shown where your argument is wrong.

You actually point to it yourself here: “It never matters what one’s debts are. It matters what one’s assets are. As long as the latter exceeds the former by some margin, lenders shall always be plentiful.”

You start with the self-evident truth that government doesn’t finance itself and will never pay back its debts. Shouldn’t lenders to the government NOT be plentiful then? The government has no assets of its own. The only assets it can offer to lenders are assets taken through taxation. Your challenger is correct to point out that no one would be willing to lend to the government without their ability to tax. The government cannot just incur ever-increasing amounts of debt in perpetuity, borrowing from further lenders to pay previous lenders in perpetuity. If that were the case, why would any government ever default?

You said it yourself: Government does not fund government. It cannot pay its debts or the accruing interest. That task falls to the taxpayer, or rather resident citizen.

Is it in the interest of those resident citizens to repay to resident lenders the public debts incurred?

The answer as demonstrated is no. The cost is immense and the benefit nil.

If the cost of doing X far exceeds the benefit of doing X, then why do X? Why indeed!

I did not say government could not tax, only that it would not tax given the cost and benefit analysis.

The government as you plainly admit funds nothing. Resident citizens incur the debts because they are on the hook for them. Not the government.

So can resident citizens incur an ever rising amount of debt and interest?

The answer, as any corporation, bank, firm or individual may assert, is yes. As long as assets exceed liabilities. And an incurred debt shall engender a rise in assets of almost 3 or 4 to 1.