Public Debt is not the Problem

An article by John Horvat recently appeared on American Thinker decrying the dangers of deficits and accumulating public debt. Mr. Horvat repeats the old saw that the deficit, that being public expenditures in excess of tax revenues, threatens and harms the financial well-being of a community or jurisdiction, burdening future taxpayers with accumulating public debts and obligations incurred for doubtless dubious public expenditures in the present.

I marvel that so many learned men and women continue to repeat the same blunder in reasoning upon this subject. But how could they not with the present public finance model plagued as it is with errant notions. The problem facing western societies is not ‘funds spent in excess of tax revenues’, but rather the massive waste one witnesses in all public spending regardless of whether funds are taxed or borrowed.

Suppose we have a nation with public expenditures in the amount of G. Suppose that 80% of said funds were squandered on the usual fruitless endeavors: welfare state initiatives or red-tape laden regulatory bodies. The Deficit Fetishists or Defetishists argue that as long as G is fully funded by Taxation, then all is well in the financial universe; that such waste is inconsequential as long as no funds are borrowed.

Suppose a troubling event, perhaps a recession, strikes the community compelling its government to increase G by large fractions, say to 1.25 G. If one follows the deficit argument, all issues are resolved if the authorities increase tax rates and, if needs be, impose new taxes to cover increased public expenditures regardless of whether funds are spent well or ill. The problem is not that public expenditures have increased or by how much, nor the pain and depressive effects inflicted by an augmented tax burden on the retreating wealth of a community, nor what the public receives for funds surrendered. They say the problem plaguing the nation is its funding source: Taxation being the good and blessed path, and Borrowing not.

Suppose the detrimental event were a war forcing increases in public expenditures to multiples of G. Whilst the nation fights for its life, the only concern Defetishists would be whether or not augmented public expenditures were covered by existing taxes or new impositions. Ignore the fortunes of battle and fight the deficit lest future generations, assuming victory, suffer the deluge of debt!

Not the war cry one would expect! I half expect that if the authorities were to decrease wartime G while maintaining tax rates and revenues, resulting in surpluses and acutely hindering the war effort, Defetishists would cheer.

The great peril for all nations is not how the government funds its operations, but rather what it does with the money. As I have said before,

“In a system of Taxation, the public has never been treated to an account of the costs and benefits of public goods. As government has always availed itself of the right to take or tax even in conjunction with borrowing, it has never had to create, develop, or refine tools required to discern good government expenditures from bad. In the past, one witnessed only a crude and dishonest accounting of the costs of public initiatives subject to numerous revisions wherein costs invariably inflate. Benefits were never considered. The good old days have yielded to the common practice of rarely mentioning costs amid clamorous insistence a public expenditure is always worthy.”

Suppose 80% of G is directed to wasteful public endeavors, without justification or returns. The massive sum, so arduously earned and conserved, may have been retained by firms and individuals for investments, savings, consumption or retirement of debt. It could have funded worthy enterprises: better schools, medical care and research, new plants and factories, all generating improved and novel products for desirous consumers.

Strangely, Defetishists ignore the enrichment of resident citizens that may spring from a more conservative and politic use of public funds as much as they ignore the returns generated by the remaining 1/4 of public expenditures deemed worthy. If returns on salutary public expenditures exceed costs incurred, including debt charges for funds borrowed, would they be a burden to future generations?

Firstly, before claiming that deficits harm future generations public finance practitioners should devise and employ a measure of the success of public expenditures. At present none has any idea which public investments are profitable and which are not. If 80% of public expenditures fail to measure up to a certain standard of benefit, not for the government, but for those supplying the funds or underwriting incurred debts, then the harm inflicted on future generations is clear.

For example, a police department bears an immense cost. But what is the benefit? One could use insurance costs to arrive at the benefit. Comparing the costs of insuring goods or property in a district with a police department to those in a comparable district without law enforcement may provide some answers.

Secondly, do deficits, money spent in excess of tax revenues, harm future generations?

A basic premise in Public Finance theory is badly flawed. It is thought that the government funds itself, that tax revenues supply the government with its contribution to public expenditures. But taking or taxing is not earning as any wage earner or retailer may confirm. If forced confiscations comprise a government’s contribution to public expenditures, then any thief is bizarrely self-sufficient.

Government possesses no hoard of money, no assets, no resources with which to meet its daily needs and, therefore, cannot fund public expenditures. It never has and it never will. Its contribution to public expenditures is nil, nada, nothing, and has been since its inception. Thus, the deficit is every dime spent by government.

In the United States federally the deficit is not $1 trillion, the projected deficit pre-Covid, but rather its total expenditures, or above $4.5 trillion. The addition of state and municipal government expenditures elevates the deficit to approximately $7.5 trillion. And if one were to sum the public expenditures extending back to the inception of all governments, one begins to grasp the true depth of public debt and deficits, unaccounted as they presently are.

Taxpayers, or more fittingly resident citizens, and further the aggregate of their property, assets, and income comprise the source of outlays for ALL public expenditures, in the US approximately $7.5 trillion before the Coronavirus set in and certainly not some petty $1 trillion.

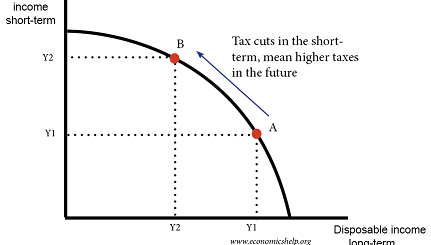

Does it matter to future generations if government taxes or borrows from resident citizens to fund public expenditures? A man by the name of David Ricardo answered this question 200 years ago with a clear No.

If government requires $5 for some public expenditure, that amount leaves the bank accounts of resident citizens by Taxation or Borrowing. So far no difference. If borrowed, there is some extra paperwork. A bond is issued in the amount of $5. It constitutes a claim or liability against the combined assets of resident citizens. But as resident citizens, specifically lenders, hold the $5 bond, it also constitutes an asset. As the $5 asset and liability sum to zero, the finances of resident citizens are unaltered.

If the state adds interest of say $1, then the liability or claim against the assets of resident citizens rises by $1 to $6. But so would the bond or asset held by resident citizens, specifically lenders. Again the $6 asset and liability sum to zero with finances of resident citizens unaltered.

If the government decides to settle the accruing debt or claim against the finances of resident citizens, it would collect $6 from resident citizens, specifically taxpayers, and hand it to resident citizens, specifically lenders, with the bond or public debt, an asset and equivalent liability of $6, extinguished. Certain of future generations would gain $6 and others lose $6, but the aggregate finances of resident citizens would be unaltered through all such transactions.

Public debts do not harm future generations. What truly harms the public, that is present generations ramifying to future ones, are prodigious resources garnered and squandered by governments throughout the world. It is often said that taxes are the price we pay for civilization. How wrong that statement is. Worthy Good government expenditures are the price we pay for civilization. Any excess works against it.

One should find a measure of the benefits of public expenditures and an enforcement mechanism to stop the gargantuan waste of the wealth of communities. Until then, waste, not deficits, shall destroy capitalist and free societies.