Part 1: Limiting Government: From Taxation to a Better Path

The bulk of funding for public expenditures comes from the funds flowing directly to government by Taxation. Another source, when Taxation has failed to yield the desired amount, is Borrowing.

At certain times, when revenues from Taxation flow abundantly, we have witnessed the government recklessly squander immense sums of money on countless unnecessary projects and enterprises, resulting in returns pitiably scant. Consequently, capital expenditures required for new investments exceed the diminished returns in taxes from previously mal-administered public investments, a situation that parallels conditions of the present. Enormous debts are then incurred to maintain a mediocre level of public investment. The deficits of the 70’s and 80’s swelled precipitously because of such financial blunders, and, accordingly, the suffering and hardships of the nation and its people.

When the government offers a new service to the public, whatever it be, the country should in some manner benefit. Earnings for the members of a jurisdiction should rise or costs decrease, whether for few or many, whether for a firm or the common labourer. A newly constructed road should lower transport times and costs. A new police detachment should lower criminal activity and afford relief from prohibitive insurance premiums. An extension to a hospital should ensure a healthier population. Whoever the intended recipient, the benefits collect and eventually translate into greater income for business operator or labourer, or lower costs for the maintenance of government. If the former, then there shall be greater Taxation revenue; if the latter, then lower costs for the operation of government and lower taxes. These returns should on average exceed the costs incurred to implement and sustain a needed public good or service. These diverse undertakings shall multiply with a growing population.

Since the revenues of Taxation issue from previous public expenditures, present revenues indicate the success of previous outlays of capital. Thus, one errs in estimating present or future expenditures constrained by the returns garnered from the past. Taxation has little to do with the community’s present or future public expenditures. By confounding these two distinct concepts, by confounding the past with the needs of the present or future, misery abounds.

Expenditures, made wisely, should provide greater returns and benefits for an entity. Every investment requires an initial outlay. Funds must accumulate or be borrowed. The directors of a corporation, investing $10 of a firm’s money and receiving revenue of $12, would garner a profit of $2, a return of 20%.

But it is an abnormal circumstance for a company to provide 100% of an investment drawn from its own funds. Adhering to rigid rules limits opportunities and profits. If an investment prove temporally worthy, delays in the slow accumulation of funds will prolong the project’s initiation, diminish returns, and perhaps through tardiness let the opportunity slip altogether.

Generally, a firm would provide a fraction of the required funds and rely upon a lender for the remainder. This method accelerates the procession of the investment and resultant good or service, providing for greater returns. The company would contribute to the investment, but borrow the majority. An investment of $10, $8 borrowed, yielding $12 in revenues will provide a $2 return before and say $1.50 after interest costs are deducted. This amount represents a 75% return on the company’s contributed capital. Potential profits as well as hazards increase as the percentage of the funds borrowed rises. Therefore, the prudent method for any entity would be to follow a mixture of the two forms of financing depending upon the nature of the investment.

If the financial health of the company appear solid, then the business could underwrite the whole of the investment with borrowed funds, pledging assets in support. Many corporations avail themselves of this option when conditions obtain. Real estate companies, possessing little capital but vast holdings of land, may pursue such a course. If returns are inadequate, the firm may offer assets as security or sell them to repay the portion of the loan outstanding.

Government funds projects through Taxation and Borrowing, the former always dwarfing the latter. This has been the practice for years. Thus, government investment usually exceeds, marginally, the funds available through Taxation. Most would agree that this conforms to fiercely sound and even unnaturally restrained financial practice; That it does not run counter to prudent or conservative behaviour. That government borrows only a small portion of the funds required, relying upon the wealth of the nation for the rest, greatly retards the provision of the good or service and limits the returns of each investment. Government should in fact institute a more business-like mixture to ensure optimum returns.

The periods during and following the Second World War, as with any great tumult or insurrection, are notable for the divergence from accepted thought and practice of public expenditure. A nation embroiled in large-scale conflict such as WW2 compels the economy into a gigantic public works’ project. Enormous expenditures are required to convert the economy to war production and, with victory, to reverse the process. Borrowing quickly vanquishes Taxation as the dominant source of funds. Public investment and accumulated debt far eclipse levels previously declared intolerable. Unprecedented amounts of capital are infused into various enterprises for the prosecution of the war: munitions, transport, aircraft, electronics, communications, computers, food provisions, rocketry, and numerous other areas. The surging investment in WW2 did yield astonishing advances among the incalculable and horrific losses in life, material, property, and wealth. The extraordinary efforts had to unleash such advances as the life of the nation depended upon them. Such advances did with the conclusion of the war find swift adaptation to civilian uses.

Some investments yield nothing, the majority yield something, and a few yield immense returns. When the conflagrations ceased and the economy reverted to a civilian production and manufactures, renewed trade and commerce begat greater tax revenues and wealth, which enlarged the public credit. It is profoundly significant that a government frequently funds ventures devoid of immediate or general application. Such ventures usually acquire their optimum utility and returns when exploited in the private domain.

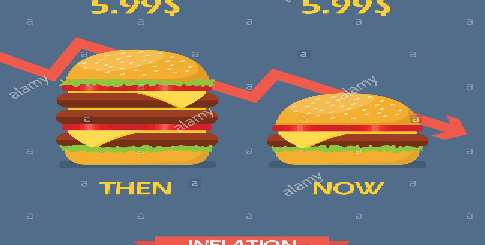

Advocating war, comprising boundless slaughter, destruction, and disruption, or immense capital works projects, contrary to the belief of many, does not address the ills of a nation. With the undertakings and relentless demands placed upon a nation’s labour, resources, and finances, there arises the problem of inflation.

It is often thought that a nation must spur demand during recession; That the Government administration should acquire funds to hire those idled for certain public initiatives. With wages paid, the labourers then enter the shops and markets of the nation, mingling and competing for the available goods produced by others. With demand rising, it is thought that the nation’s producers will respond by hiring more staff to supply expanding needs.

This hope is forlorn to perceptive minds. With idled labour and resources consequently diverted to worthless endeavour, the prices of labour and material rise, leaving manufacturers and merchants with greater costs in operations. Thus, the best option for many firms is to raise prices rather than invest, hire and compete for lower returns.

There may be some success with such public initiatives, but generally most fail. They are not designed with the objective of augmenting the supply of prized or desired goods in the marketplace. They are designed to appease the devotees of certain political parties and representatives. Reckless and empty labours furnish goods, as with most government goods, that must be dubious, that must possess little or no value to the consumer, but great value to those dependent upon the well-being and sentiments of legions of despairing voters.

If borrowed funds, then the supply of money rises without consequent increase in the supply of goods, with inflation or deterioration in the value of money as the result. If taxed, those who do produce valued goods are stripped of funds and hindered, and those who do not are enriched. What an incomprehensible and crazed body of rewards and penalties this must be?

The former Soviet Union and present day North Korea have pursued these maniacal objectives to perfection, having left the nation and its people starved of vital civilian goods and deluged with the worthless goods sanctioned by incapable administrators. The problem is not a lack of demand, and never is. The problem becomes with borrowing a lack of supply, or too much money chasing to few goods, known as Inflation. With increased or punitive Taxation of the productive members of the land, a mixture of faltering demand and supply.

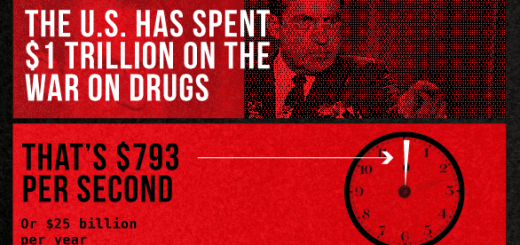

The great challenge in public finance is to limit government to expenditures of acknowledged and confirmed value. Taxation did once confine government expenditures, limiting it to the annual revenues furnished by the land. Many deemed any expenditure beyond amassed revenues imprudent and dire. However, recessions diminished revenues, which compelled government to extract deficiencies with greater claims upon an anguished people. Robust periods filled the government purse, which ensured greater expenditures and greater demands upon productive resources well engaged.

In our modern era and economies, government has discarded the constraints of revenues by recourse to borrowing when deficiencies arise. Unfortunately, injudicious and perilous practices have rent the notion of curtailment in expenditures during robust periods and expansion during contractions. It now seems that we are forever in recessionary periods, and government is a growth industry. If it continue, the totalitarian state of the former Soviet Union or presently North Korea does not seem such a distant nightmare. Our approach to this horrific reality is accelerating.

But contained within there lies the remedy to present economic malady and inertia. The exorbitant expenditures of war and the apparent wizardry employed to maintain this bewildering series of borrowing, expending, then borrowing in greater amounts and expending in greater amounts confounds even the most ingenious. How can such an immense expansion of debt be maintained indefinitely? We have only to isolate, extract, and implement the elusive method without the encumbrance of war. That exposition will follow in another article.