Misconceptions of Inflation

INFLATION

The one great flaw marking modern money is its relentless deterioration in value, which condition is denoted Inflation. There are a number of misconceptions regarding Inflation or its lesser known counterpart, Deflation, that have been in existence for centuries. These blunders arise from critical misunderstandings of what money is and how it operates. Inflation simply arises through the creation of money without purpose, by additions to the stock of money without proportioned additions to the stock of goods. This event springs from 2 sources: a steep augmentation of the monetary base or currency, and the enlargement of the stock of money occasioned by the satisfaction of a rising demand for credit.

Economists have advanced two primary theories to explain this complex subject: Cost-Push and Demand-Pull Inflation.

With Cost-Push inflation the rising price of certain essential goods compels retailers, labourers and others, in consequence, to demand greater prices or wages. In the 70’s, purportedly an engineered and precipitous increase in the price of oil, one of the most fundamental of modern commodities, ignited a potent, painful, and enduring interval of inflation. The resultant rise in the cost of this essential commodity ostensibly and immediately impelled any and all to raise the prices of goods and services or claim greater wages.

This contention must be as ridiculous as it is erroneous. A rise in the price of oil sows an effect that is generally depressive or recessionary, not inflationary. Observed in isolation, one may designate with certain license a surging oil price as inflationary, but only for the market value of this item alone. Such an event would retard economic activity and trade coincident with the commodity’s use in the economy.

Let us imagine that the quantity of money in existence is relatively fixed during a period in which the price of oil escalates through designed or natural scarcity. If one earns $500 during a span of time and normally directs $50 to the acquisition of oil or petroleum products, a greater quantity of money, say $80, will be required to purchase an identical amount of oil at the elevated price. Therefore, the buyer must curtail expenditures of $30 from among his limited funds.

The consumer may be able to compensate for diminished expenditures by drawing upon financial reserves, by amplifying existing income, or by incurring debts. The first measure, the reduction of existing savings, curbs the value of assets one possesses, leaving him poorer and depressing future expenditures; Adding to existing income if possible requires a greater use of one’s time to generate the same level of expenditures, marring one’s leisure; and the third, incurring debt, sustains present demand with future earnings. The majority of persons will not exclusively draw down savings robbing themselves of future consumption, seek other employment, or incur debts. Most will in some combination attempt to curtail other expenditures wherever necessary or curb the use of oil. Whatever option is selected, the retardant effect shall be felt, immediately or subsequently, and may be severe if the commodity’s price rise be acute and durable.

$500 of income will remain approximately $500, and expenditures, present or future, must suffer. Thus, industries producing the goods afflicted with waning interest will oblige changing market conditions with a moderation in prices or the expansion of inventories, until production slows or ceases. The effects will radiate and ramify. A slowing economy and, consequently, declining oil demand, should force partial retreat in the price of oil. If the elevation in price be prolonged by natural forces or by manipulation, one may alter his dependence by seeking alternative sources of supply or by discovering or observing conservatory practices. With the price rise fleeting or fresh, these avenues are difficult to pursue.

Whatever occur, in the immediacy of an oil price rise most can do little, save reduce consumption in oil, a laborious undertaking given oil’s fundamental and broad applications, or reduce consumption in other areas, both having general depressive outcomes. As the use of oil wanes and the price moderates, it is hoped there will be a recovery in economic activity.

Alternately, a moderating price of oil will act to spur the economy, fostering expansive forces as less money dedicated to the purchase of oil releases greater sums for the purchase of other goods.

Demand-Pull theories of Inflation furnish a description of the event without a determination of cause. It is argued that such Inflation occurs when a rise in aggregate demand for goods and services surpasses the rise in aggregate supply, creating shortages and thus rising prices. With only vague and terse mention of the effect of augmented aggregate demand, one must ponder the cause of this condition himself.

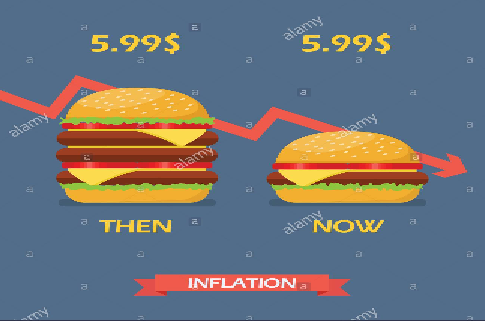

Truly, Inflation is not caused by an elevation of the price of oil or of some other esteemed or versatile commodity. Prices of individual goods fluctuate all the time when changes in market conditions occasion changes in the supply of or demand for an item. Rather one discerns the nefarious force of Inflation wrought within a general rise of the prices of all goods. This situation is borne of an increase in the quantity of money, either by the expansion of credit or bank money which is most probable, or by the enlargement of the supply of currency.

When the quantity of money in the economy augments through the loans process, not every such instance generates Inflation. Corporations and individuals are free to borrow any time they wish while rewards outweigh risks. Any entity can add to the stock of money by borrowing, by approaching a lender and acquiring a loan, if the returns of a venture justify the costs

Suppose in a single firm economy, a company produces 10 fridges per year with the stock of money held to some amount. Each fridge sells for $10,000.

If the company borrows $100,000 and invests in new equipment, it can now produce 25 fridges per year. The stock of money rises by $100,000 through the loans process. But the value of added goods produced has risen by $150,000. The company may maintain its price to garner greater profits, moderate the prices if competition demands, or settle on a combination.

Suppose the firm pares the price to $8500. Some would argue that such result should be denoted Deflation. The assessment is wrong. It is the markets at work. A new manufacturing technique or device appears that allows for a reduction in the costs of manufactures and consequently price. Having to pay less for certain items means having more money, $1500, to spend on other items. The project enriches the firm and the community of buyers.

The Interest Rate is the arbiter of all decisions on investment, savings, and debt. If the interest charge be higher than the return on invested capital, then delay is best. If the opposite, if the charge be inferior to returns, then the investment should proceed. Commercial enterprises, merchants and individuals suffer consequences of poorly considered investments in the financial markets. If a venture fails, hopefully the company or person escapes ruin and survives until the next commercial opportunity arrives.

However, there is only one organization on this planet that can ignore the dictums of sound finance with near impunity. Government, and more a national government in control of a sovereign currency may borrow and squander all it desires.

Inflation is caused by expansion of the money supply without corresponding expansion of aggregate supply, i.e. money created without purpose. Governments, by borrowing and spending frivolously, without regard to the financial costs and benefits of its actions, add greatly to the quantity of money whilst generating little of desired aggregate supply in return. Thus, whenever a nation experiences inflationary pressures, one can be sure that the national government is diverting borrowed money, labour, equipment and materials from productive to unproductive pursuits, depleting the resources of the nation in producing goods that none need or seek. Yet, with the stock of money enlarged amidst a stagnant supply of goods, all persons, employed worthily and unworthily, possess the means to buy goods. Thus, prices must invariably rise. If the diversionary efforts are limited, we face the ordeal of the 70’s. If pronounced, we suffer the Soviet or North Korean tyranny of endless want.

Periods of escalating prices occur simply because governments repeatedly fail to follow prudent and seasoned financial rules that must apply to us all. During economically energetic periods, government strip monies from the productive class and fritter them on the unproductive class, generating little in returns and frequently great losses, impoverishing all. When tax revenues fail to yield the funds required to accommodate the proliferating and accelerating supply of public services, governments at the crest of the business cycles, ignoring rudimentary financial common sense, expend funds borrowed at exorbitant rates on projects bearing slender returns or full losses. Even as interest charges elevate precipitously, the thirst for government expenditures by self-important leaders and their eager employ rarely subsides.

Suppose the government requires $1 million for some public venture: a job creation project consisting of workers digging holes in the morning and filling them in during the afternoon. The government borrows funds from the community, hires labourers, and acquires materials such as shovels. The project commences. Soon the percipient shovellers realize the result of digging a hole and subsequently re-filling it may be achieved by retreating from the task altogether. Thus, most efforts cease as the wise majority withdraw to pleasant leisure while still collecting full wages.

At the end of the project, those engaged were paid to produce nothing for the $1 million received. They did not construct houses. They did not assemble cars. They did not attend to the ailing. They did not cultivate a field. They did not forge steel. They did not create any saleable or valued product. If none had engaged in the designated work, the result would have been the same. The Dig and its assorted workers in competition with those employed advantageously certainly consumed scarce materials, equipment, and domestic goods. But the good offered by the project none needs, none values.

Unfortunately, these worthless endeavours mark many public projects. Amidst a stationary aggregate supply the amount of money in circulation swells with deteriorating value, siring a general rise in prices. In the late 80’s and early 90’s, the adversities of Inflation subsided as crushing interest rates, caused by previous government mal-administration, vanquished the enterprising, productive, and prudent. In this nation of Canada, the remedy ludicrously consisted in enormous tax increases to combat and balance the immense accumulation of debt and exorbitant interest charges. With ignorant folly came wretched blunder.

Enlargement of the money supply can also occur through the printing and circulation of currency, money’s physical and diminutive component. It is a rare event, perhaps a financial calamity, which forces the payment of expenditures of government by newly minted bills or coins. If the augmentation be immoderate, well beyond the currency demands of the financial markets, the culprit in the resultant inflationary surge will be invariably the desperate hand of government or its designated agent.

Small increases in the supply of currency eventually sires large increases in the stock of money. In Canada, there is $1 of currency notes in existence for every $25 of bank money or credit. Let us say that the total value of all Canadian currency in coins and notes adds to approximately $30 billion, and the total value of all deposits at the major banks amounts to approximately 25 times this amount or $750 billion. The actual amounts are greater, but we may work with these figures.

If the state adds $10 billion in currency to the money supply, one would expect the stock of money to rise to $790 billion from $780 billion ($750 billion plus $30 billion). However, it will enlarge the stock of money by $260 billion. In restoring the $1 currency to $25 bank money equilibrium, $10 billion in currency will move through the financial system creating through a multitude of loans and subsequent deposits $250 billion in bank money. When stability returns, the stock of money will have expanded from $780 billion to approximately $1040 billion, almost 33% larger.

Rapid or large expansion of the currency would swiftly destroy the value of money. It is a tool that should never be employed. If the government finds itself in financial hardship, it the preference should be to borrow funds by offering bonds to financial markets instead of printing actual currency. Irredeemably reckless states may find lenders scarce and hostile. Hence, they are left with no other option than the ruin of the monetary unit.

The interest rate is the lever that retards ardent and ubiquitous demand for credit, and generally among the private citizen and commercial interests it works admirably. Enlargement of the money supply through the natural process of lending leads to increases in productivity, issuing from investment and its returns. The expansion of the goods produced will counter the effect of a greater amount of circulating money.

When Inflation emerges, often in moderate form, but infrequently in immoderate and harmful form as well, the culprit is invariably the Government. Government is unaccustomed to justifying the worthiness of expenditures. Leaders frequently flirt with frivolous and politically useful public enterprise and squander, which blights and perverts the fine mechanism of risk and reward.

To squelch or limit Inflation, a nation must ensure that wealth accelerates at a far greater rate than the debts incurred to secure that wealth. For the individual or company, the means of ensuring the average returns upon borrowed funds far exceed average costs is an instrument long in existence and ably utilized. The challenge is to compel and bind government to the same course. Let the money supply grow by 5%, if the average investment yield be 10%. Let it be 20% if the yield be 50%. But never let it be 2% when the yield be naught.