How Will a Community Repay its Public Debts without Taxation

The proof has prompted numerous questions which elicit answers many find difficult to accept. This is understandable with novel concepts. Many have repeatedly asked how the Government shall repay resident lenders their loaned funds when it apparently has not the means of doing so, when it no longer can arbitrarily turn to the community and confiscate the needed money.

The Government is not the party that generates funds to repay debts of any kind. I have no idea why people assert that an entity which contributes nothing to settling its financial affairs is sovereign and independent and must act accordingly.

Do recall that the government does not furnish the funds with which to settle its debts. Government does not pay taxes. It does not fund public expenditures. The government is in deficit to the full extent of its expenditures, not just to that amount not covered by Taxation revenues. Were one to account the finances of government, it would reveal a shocking indebtedness to the Taxpayer of the sum total of its expenditures from inception. Government in its long history has not and nor shall it ever contribute $1 dollar to settling public debts or funding public expenditures as it generates none of its own revenues. It conducts the nation’s public business for the benefit of the nation. The task of funding public expenditures and settling public debts has always fallen to the Taxpayer.

Given that a community of Taxpayers funds government, it is their finances: their assets, incomes, property, financial instruments, and money, one must look at and examine in order to answer basic questions about funding public expenditures.

That is all I have done with the proof. One easily discovers that it makes no difference whether a community taxes or borrows from its citizens to fund public expenditures. In the proof, $10 million leaves the bank accounts of taxpayers or lenders never to return. In the instance of Borrowing, there is some extra paperwork.

If one were to add a financial asset of $50,000 and, simultaneously, a liability of the same $50,000, has the state of that person’s wealth declined, improved, or remained the same? If one should release the asset for a sum equivalent to the asset’s accrued liability, would that person’s wealth expand, diminish, or remain unchanged?

If one should add to the assets, property, incomes of community residents whilst simultaneously creating an equivalent liability or claim against said assets, this action does not alter the aggregate finances of community residents. Nor are they altered if one should simultaneously extinguish an asset and equivalent liability.

If a community should authorize its government to issue a bond, of which the purchase is restricted solely to community residents and to the designated currency, to fund some expenditure, that bond bearing an amount and interest rate shall add an equivalent amount to the community residents’ assets, specifically the assets of those who lend, and to its liabilities, specifically claims upon the assets of its residents. If a community has its government extinguish that bond through repayment by Taxation, the action will erase not only the asset held by community residents, but also the liability claimed against the assets of community residents, leaving aggregate finances again unaltered in the transaction.

Before I address the issue of repayment or settlement of a community’s debts incurred by its appointed authority, I shall make several comments.

When has the government of a community ever retired or reduced its aggregate debts?

One says that the government must pay its debts. Yet, should one look throughout US history, he will find the US has never retired any debt contracted by its government since its birth. Federal public debt has gone from $2.5 billion in 1910 to $43 billion in 1940 to $17 trillion today. These are not declining numbers. The condition afflicts state and local levels of administration, and governments throughout the world at all ranks.

Once a public debt is contracted, it remains forever an unpaid obligation. Existing public debts are easily exchanged in the financial markets, and newly issued obligations strangely and generally meet with receptive buyers. I suspect the reason for endless accumulation of public debt may be found in always greater demands upon the resources of a community by a growing and prospering populace. A larger and wealthier community invariably has need of more services and goods. Since a large fraction of public expenditures funds future investments and the revenues of Taxation issue from past investments, one must expect Borrowing to sate the deficiency.

To demand or insist that public debts must be retired when the date of settlement arrives disregards the evidence plain to us all.

Corporations are little different in their accumulation of liabilities, always borrowing ever greater sums to fund the growing demands for their products or to exploit lucrative or novel opportunities. The debts of IBM 50 years ago must appear a sliver to those of the present. The debts of all US corporations of today must dwarf those of years past. There are rare occasions when those debts decline, but the general drift is inexorably to greater debt. Even the wealthiest corporations count financial debt among their liabilities.

Individual persons also possess debts. And for most of one’s life, debts do grow with education, marriage, children, housing, transportation. However, people live a finite existence. Temporal considerations compel debtors to limit or reduce liabilities as they near the end of their existence. Creditors tend to request repayment of funds before one’s life ceases, but recourse to an estate often guarantees reimbursement. Corporations, firms and governments do not operate under temporal constraints.

Insurance companies take upon themselves an ever growing list of future and estimated risks from others for payments in the present. The industry invests these sums to provide a large reservoir of money when claims eventually appear. So many unknowns and risks, yet it is a profitable industry.

So in effect, once a corporation, public or private, borrows money, it is forever borrowed. This is an indication of investment for future returns.

Banks borrow large sums of money and loan them to various borrowers, living on the margins of the rates of interest charged to borrowers and paid to lenders. The amounts borrowed proliferate as the years pass. Thus, banking practices compel lending institutions to eschew reductions or limitations upon liabilities. .

If one should look at the deposits held by the Royal Bank of Canada from its establishment 200 years ago to the present, one shall easily discover that they have grown substantially. And 200 years from now, barring disaster, they shall be that much larger.

So with increasing liabilities, how does a bank satisfy its lenders when demands for repayment arrive? Standard banking practice is simply to exchange one depositor or lender for another. This may come as a surprise to many, but it is a fact. If a depositor should request return of funds, which have been extended profitably to a person or enterprise, does the bank revoke a loan? As a bank does not appear to have a large waiting room to accommodate its many needy depositors, I presume that other borrowers have been located and engaged prior to the exchange, freeing up funds for swift remittance. For those entrusted with the money of others in the most conservative of institutions these are sound and long established practices.

A community or nation follows this prescription as past and present practice irrefutably demonstrates. The public debt of Canada, originally diminutive, exceeds that initial pittance exponentially. It is the same with every government. The debts of those entities free of temporal restrictions accrue and expand to ever greater amounts. It is rarely the case, and not for good reasons, that the debts of a public or private corporation or a bank will be less now than they were 20 years ago.

There are few entities on this earth that do not count liabilities in their records. Most of us carry debts and many other liabilities. In public finance, the debt is what immediately draws one’s attention. Most ignore the assets that these debts have created. Imagine if one were to only look at the debts generated by banks, firms and individuals. All would be on the financial precipice. The finances of Warren Buffett, Bill Gates, Apple, Microsoft, the United States, every nation, firm, and individual would be immediately assessed as dire and irreversible.

The interest one should evince in such matters should not concentrate solely upon the size of one’s debts, but rather upon the size of one’s assets held in opposition to those debts. Does one possess assets exceeding aggregate liabilities. Most queried will say yes, some unfortunately no.

As long as corporations can generate assets exceeding accruing liabilities by some margin, then none should be concerned with liabilities.

As long as a bank can generate assets, investments or solid loans, greater than liabilities, it can grow without end. As banks live on the margins between money borrowed and loaned, equity frequently is generous at 10% of liabilities.

If a corporation could generate assets of $2 for every $1 invested, would one hesitate to lend to such a profitable entity all that it desired?

Let us say that in 1994 an entrepreneur obtained with the good will of a lender a loan of $150 million US and exchanged this sum for one NFL franchise. Over the course of 5 years, the team, after meagre profits and some losses, managed to remunerate the purchaser $1 million US. Thus, the owner is left with interest charges upon the principal, and, in addition, interest upon money borrowed to pay the annual interest charges.

At the end of 5 years, the total amount to be remitted to the lender has expanded to a sum of $239 million US at an interest rate of 10%. This figure consists of $150 million US principal, $75 million US of interest charges upon the principal of $150 million over 5 years, $15 million in interest charges upon money borrowed to pay the interest charges, and the subtraction of $1 million US in accrued profits.

Was this a lucrative investment? Most would immediately say no, but an astute few might plead absence of crucial information. “What is the present value of the franchise?” these persons might ask. With the answer provided, a proper determination can be made.

According to figures for the year 2000 an NFL franchise had an estimated value of $500 million US. Hence, the answer to the question becomes undeniably, “Yes.” It was an immensely profitable venture. With no more than the kindness of a lender and perhaps a surety, the entrepreneur created personal wealth in the amount of $261 million during a 5 year period, paying the costs of interest by borrowing against the increasing value of his holding.

2 years thereafter, the franchise may be worth another $80 million US with the costs of interest amounting to $50.19 million US on the growing sum of principle and interest outstanding. As long as the investment increases in value beyond the initial debt and accruing interest the owner may retain ownership of the asset.

One need not pay the piper as long as the piper is content with the security of the loan, or as long as there is another piper to substitute for the former should the first demand return of his funds. In such an instance, you can always pay the piper by indefinitely borrowing more against the inflating value of the asset created or purchased.

Is a corporation with $1 million in assets and no debts in better financial shape than one with $10 million in assets and $5 million in debts?

Is a nation with $50 million in combined assets among its citizens and no public debts in better financial condition than a nation with a similarly sized population and with combined wealth of $250 million and $100 million in public debts?

If a community can borrow from within, from its resident citizens, and create assets within that community and among its residents exceeding the acquired liabilities, should it not do so? Should it reject the known rules and practices of profit that all others eagerly pursue?

It shall be the same for a community of residents as it is for a corporation or person. Borrow from residents and invest in some project, creating assets that exceed liabilities, enriching the community and its people.

I have written an article that details the great wealth unloosed by the divine measure of abolishing Taxation. It is found here: https://www.economart.ca/the-idea-in-operation/

So will a government pay back lenders?

An individual lender to the community shall always receive their money, interest and principle, upon demand. The community via its government shall simply exchange one lender for another, just as any financial lender or corporation, which never appears to make good on its aggregate debts, furnishes requested funds.

A community or nation need not repay the debt as long as the lenders are certain of the security of the loan. It only becomes a matter of settling on an agreeable interest rate for both borrower and lender. Market conditions or the supply of and demand for money shall settle the matter. If there are few lenders, the interest rate must rise to reflect the forces of risk and reward. If there are many lenders, the interest rate will moderate. Pension fund managers in any developed nation are vigilant for solid investments and good returns. The large appetite for most public debt among these most cautious investors reflects this prudent and rewarding method.

Can the community actually reduce its aggregate debts by Taxation?

I have never said the government is forbidden from use of the instrument of Taxation. The community has the freedom to sanction its agent, the government, to institute a tax at any time it should please to collect funds by Taxation to retire debts or to fund public expenditures.

But would it ever be in the financial interest of those inhabitants of a community to reduce outstanding debts by recourse to Taxation?

I have said that as the proof with brevity and certainty demonstrates Taxation bears detrimental costs and no financial benefit for a community of residents. I shall give an exposition of the proof so that this point is clear and unquestionable.

As has been said several times, the source of the community’s funds for public expenditures is not the government. Why would any serious enquirer analyze the government’s finances knowing its precarious financial position? As all of its revenues issue from another, shouldn’t one analyze first and always the finances of those that actually pay the government’s bills to determine the state of public finances and the effectiveness of public expenditures?

If some entity were to add a sum to both assets and liabilities, has its financial position changed? Suppose a corporation holds many bank accounts. In one bank account, say A, there is $50,000. In another bank account, say B, there is nothing.

A agrees to give B the money. A is out $50,000.

Now let’s say that A agrees to transfer the money to B, but rather as a loan at some rate of interest. The $50,000 transfers from A to B. A registers an asset of $50,000 plus accruing interest; B registers a liability of $50,000 plus accruing interest. A is again out $50,000, but it does hold an asset for remittance of funds. B suffers the imposition of an equivalent liability.

In either case, A is out $50,000 and B is similarly enriched. However, in the latter case, an asset, an IOU held by A, and an equivalent liability, an IOU issued by B, have been created that when combined sum to nil. Has the creation of this asset and equivalent debt changed the financial position of the corporation? No, clearly. The asset annihilates the debt.

If B were to collect the sum of the outstanding debt, say $75,000 with principle and interest, from the other bank accounts of the corporation and transfer it to A, $75,000 transfers from accounts of the corporation to other accounts of the corporation, and the debt imposed on B and the equivalent asset held by A is erased. With these latter transactions, has the financial position of the corporation changed? No, clearly.

What was the benefit of B repaying its debt to A? In the aggregate, nothing was achieved. $75000 transferred from and to accounts within the corporation, and an equivalent asset and liability were nullified. There was no benefit to the corporation in having B retire its debt to A.

If the corporation in question were a community of residents with numerous bank accounts along with an account for its governing body, does the relationship and results among participant bank accounts differ from those obtained previously? They do not.

Firstly, under Taxation, $50,000 would leave the accounts of the residents of the community for the Government’s account never to return.

Secondly, suppose the government within the community or jurisdiction borrows from its residents, specifically its lenders. Imagine that B is the bank account of the community’s government and A represents the aggregate accounts of its lenders. Funds are borrowed in the sum of $50,000, which leaves the accounts of A for B never to return, the identical result obtained with Taxation. The proffering of funds by A results in the creation of an equal asset of $50,000 and accruing interest for A and liability of the same for B. With interest compounding through the years, resultant liability and asset elevate in value, yet remain equal. Each annihilates the other.

If in the future a theoretical settlement of the public debt occur, the government would collect the money, now say $75,000 with compounding interest and principle, owed by the community to its resident lenders, A, from its varied other members, represented in the aggregate by the accounts of C. The amount in the community members’ bank accounts, C, would fall by $75,000 whilst that of the government’s, B, would rise by $75,000. The Government would then transfer the $75,000 to its resident lenders accounts, A. The government would take possession of and cancel the community IOU, nullifying both asset held by resident lenders and liability claimed against community residents.

What was the benefit to the community in having its government retire the debts owed to its resident lenders, A? $75,000 transferred from accounts within the community, C, to others within the community, A, leaving the aggregate finances of community residents unchanged. An IOU, an asset among the property, incomes, money, financial instruments of community residents, specifically lenders, and an equivalent liability held against the property, incomes, money and financial instruments of community residents, was revoked and cancelled. An asset and equivalent debt were nullified. Nothing was achieved. The community is neither wealthier nor poorer prior and subsequent to the retirement of its debts.

All created debts and assets sum to nil before the transaction and after the transaction. The financial benefit of reducing the public debt of the community is nil. However, the costs in using Taxation to collect funds to retire the community’s debts are immense in government squander or, at least in this one instance, in its deterrent effect.

All I have shown above in my proof is that the liabilities incurred through a nation borrowing from itself exactly equal the financial assets generated by the nation’s borrowing. The addition of $1 to liabilities means a nation automatically adds $1 to its assets. The created assets annihilate the created liabilities leaving wealth unchanged.

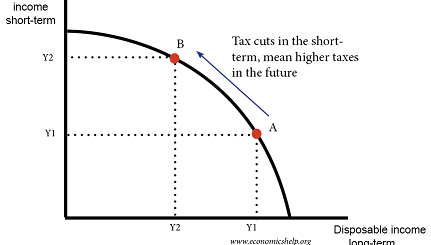

If borrowing by a nation of residents from its residents for public expenditures does not alter its financial position any more than Taxation, then why would a nation tax with all its inherent costs? It is similar in circumstance to a person or firm selling an asset yielding 50% to settle a debt with an interest charge of 0%. No rational person would ever undertake such a sale.

Why then would a nation choose Taxation over Borrowing, which bears none of its costs? Why would any rational being argue for mitigation of accruing public debts when the cost of this act is immense and the return nil? Why does a community tax with all its inherent and punishing costs to fund public expenditures when it can borrow, escaping these financial ills, and unleash great wealth for its citizens?

Thus, the community will NEVER retire any of its outstanding and accumulating debts as it is NEVER in its financial interest to do so. It is far better that a community or nation simply exchange one lender for another indefinitely.

1 Response

[…] This is discussed thoroughly in my post: https://www.economart.ca/how-will-a-community-repay-its-public-debts-without-taxation/ […]