Deficits are Not the Problem

The Real Problem is not a $400 Million Deficit

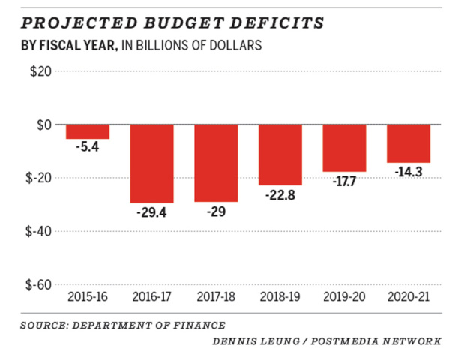

It is imagined that the deficit of the Manitoba Government is presently a small portion of its total expenditures of $13 billion – that is the $400 million not already wrung from the heavily taxed property and incomes of Manitobans. Pursuing this line of reasoning, if the Government should seize this additional $400 million through taxes, the merciless action should serve as remedy for all our problems.

Is this truly the cause of and answer to all our problems?

The problem facing Manitobans is not this small portion of public expenditure erroneously called a deficit, or in Manitoba a $400 million tax deficiency. If only this trifle were the extent of our troubles!

I and others have long argued a self evident truth: that government does not fund government. Government has not contributed one dime to its expenditures since its inception. It possesses no hoard of money, no assets, no financial instruments with which to meet its daily needs. I concede that government certainly pays its bills, however, it never furnishes the funds with which to pay those bills. If one were to examine government’s finances since its inception, they would find a long line of entries of – Money Expended – Bill to the Taxpayer.

History repeatedly assures us that public debts once incurred endure forever. Government, after seizing money from the Taxpayer, rarely direct any to repaying previous debts and prefer to keep on spending. When it does make the attempt, the effort yields negligible results. Quickly the desire for greater government overcomes the weak impulse of debt reduction, and the debts once again pile up. Even if government through the financial resources of the taxpayer sought to reduce public debts, its contribution to the effort would amount to nil for the same reason that it can never fund its expenditures. It does not, never has, and never will possess the means.

Therefore, the deficit comprises the whole of government expenditures, those outlays funded by both Taxation and Borrowing. To construe the delinquency as the slight gap between the revenues of Taxation and total expenditures challenges both sense and reason. Whether borrowed or taxed, the source of funds is undeniably outside of government.

So in order to spend, government must always draw from the collective pile of the property, incomes, and assets of its citizens. That is what funds government. They call it public finance, not government finance, and for good reason. They call it taxpayers’ money, not government’s money, for the same good reason.

The task of funding government has always fallen to the Taxpayer. So, in order to fully understand public finance, one must apply this long neglected fact. Given that a community of Taxpayers funds government, it is their finances: their assets, incomes, property, and money, one must look at and examine in order to answer basic questions about funding public expenditures and funding deficits.

In examining the provincial deficit, one easily discovers that it makes no difference whether a community taxes or borrows from its resident citizens to fund that deficit. If one should add to the assets of Manitoba residents whilst simultaneously creating an equivalent liability or claim against said assets, then one has not altered the aggregate finances of Manitoba residents. Nor are they altered if one should simultaneously extinguish an asset and equivalent liability.

If the province of Manitoba had borrowed the money spent in excess of tax revenues solely from Manitobans, presently the sum of $400 million, it would not alter the finances of Manitobans whatsoever. In creating a provincial debt, a bond issued in the amount of $400 million by the province, the Manitoba Government also creates a provincial asset, the same bond held by resident Manitoba lenders in the amount of $400 million. $400 million in bonds issued equals exactly $400 million in bonds held. A debt is created and held against the property, assets and incomes of Manitobans at the same time as an equivalent asset is created and added to the property, assets, and incomes of Manitobans. So the aggregate finances of Manitobans, the source of money that funds government, are unaltered in the transaction.

If the province of Manitoba should have its government disburse interest to its resident lenders, then the finances of Manitobans are again unaltered. Interest added to the liabilities of Manitobans is equivalent to interest allotted to the assets of Manitobans, specifically, those who lend. So the aggregate finances of Manitobans again remain unchanged.

If the province of Manitoba has its government extinguish all or a portion of the $400 million in bonds through repayment by taxing, the action will erase not only the liability claimed against the finances of Manitoba residents, but also the asset held by Manitoba residents. If the act of extinguishing a debt also extinguishes an equivalent asset, then one’s aggregate finances are unaltered by the act. If the cost of extinguishing a debt by taxing is great and the benefit nil, then one does not extinguish a debt.

The imagined deficit of $400 million is not a problem at all.

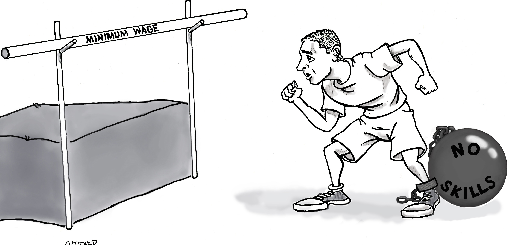

The real problem facing Manitoba and its citizens is that all levels of government in this province comprise a GDP greater than 50% of the economy. At the provincial level, the Manitoba Government is seizing $13 billion from Manitobans and spending it without regard to benefits for Manitobans. This is the chief issue and source of our ills. 50% of the economy — of the money, labour, and materials at the disposal of the province engaged in producing goods of dubious value. We have no idea what those goods, if needed at all, are worth. Do these public expenditures invariably generate returns exceeding all costs? Do they truthfully enhance our wealth and enrich our lives? Our political masters proclaim it a certainty with lip-serving platitudes, they never furnish the evidence.